the rise of East Asia startups, by mark birch

My first thought when I stepped onto the Tokyo subway was how much better it was than NYC. Trains ran on time, stations were clean, navigating was easy. I felt transported into the future 😂

Granted, the NYC subway is over 100 years old. The bulk of Tokyo's subway lines only got built after World War II. However, every aspect of Japan's system was significantly superior.

The same holds true for cars, electronics, and games. Japan has an eye for design, attention to detail, and the intense discipline to create iconic products. Which begs the question, why hasn’t Japan produced any iconic software tech startups?

I was on the 42Geeks East Asia tour recently, and over the course of ten days, we dove deep into Japan's startup scene, as well as Korea and Taiwan's ecosystems. What we learned is that the startup scene has quickly evolved and there is significant momentum across East Asia!

While we are saying East Asia as a block, it is important to note the vast differences among the three nations:

Market Size – Japan is the 3rd largest GDP in the world with 124 million people, whereas Korea is less than half the GDP and size, and Taiwan even smaller. While Japan is large enough for startups to reach venture scale in that market, Taiwan and Seoul startups generally cannot.

Notable Diaspora – Taiwan produced notably executives / founders such as Steve Chan (YouTube), Kevin Lin (Twitch), Jensen Huang (Nvidia), Lisa Su (AMD), bringing Silicon Valley style entrepreneurship and scaling experience to Taiwan.

Exit Strategies – Japanese startups rarely achieve unicorn status, but many have exited as acquisitions or going public on the local “Mothers” market. Taiwan and Korea have had less success with exits, but their ecosystems are also relatively younger.

Cool Factor – Hallyu, or the Korean Wave, as elevated Korea as a global entertainment powerhouse, making their culture cool and bringing more foreign entrepreneurship and investment to the country.

What is interesting however is that the future of Japan, Korea, and Taiwan as thriving startup ecosystems is remarkable similar. To help understand the path forward for East Asia, we looked across six ecosystem advantages and six challenges that could impact ecosystem progress.

Advantages

Infrastructure – Each of these countries are modern economic miracles, rebuilding after devastating wars. This has enabled them to develop world-class transportation, energy, and telecommunications infrastructure that helps foster innovation.

Hardware Expertise – Taiwan leads the world in semi-conductors and contract manufacturing, while Japan and Korea have world leading electronics brands (Sony, Panasonic, Samsung, LG, etc.). This provides a strong base for building deep tech and hardware-based startups across IoT, AR/VR, and industrial applications.

Education Culture – Each of these nations ranks among the top globally for schooling, due to the deep cultural value placed on education. While there is criticism for the rote nature of teaching, the result is a well-balance and capable workforce.

Collaborative Spirit – There is more emphasis placed on teams rather than individuals, which leads to more loyalty and collaboration, leading to more consistent and predictable results towards building more sustainable and healthy startups.

Engineering Skills – Where you have builders, you have innovation. These countries graduate a high percentage of STEM educated talent, fueling innovation and startup generation. While most will work for large corporates, more are exploring startups.

Government Support – Each nation had directed significant resources, capital, and policy creation to bolster their startup ecosystems. Taiwan is luring foreign talent via their Gold Card program, while Japan and Korea launched multi-year startup programs.

Challenges

Risk Adverse – Whereas Western culture is more forgiving of the solo, maverick style entrepreneurship and failure, East Asia still struggles with the concept of failure, which is a key ingredient in the startup journey, especially for finding product-market fit.

Work Culture – On the positive, these are hard-working nations. This point is more on the adherence to hierarchical management practices that stifle creativity and learning that often comes from staff in the field and filters up to the organization.

Language Barriers – India’s startup growth was to a certain degree aided by having English skills to expend overseas to the US and beyond. English however is still a barrier particularly for Japan and Korea, creation friction for global expansion.

Falling Birthrates – South Korea has the lowest birth rate in the world, and Japan and Korea are not far behind. This will be a huge drain on resources to support an aging economy with fewer resources available and shrinking tax base to support.

Talent Exodus – The most talented engineers and entrepreneurs are setting their sights on higher-paying locales like Silicon Valley, London, Singapore. While less of a factor in Japan, this is a noticeable trend in Taiwan where engineering salaries are low.

Geopolitical Concerns – Less of an issue at the moment, but as we have seen with events in Gaza and the war in the Ukraine, innovation immediately halts. With China and North Korea in the region, it is an issue that looms large for the future.

The one area we did not touch on is availability of capital for startups. Across East Asia, a total of $12.5 billion USD was deployed into startups in 2022 ($5.4 billion Korea, $6.2 billion Japan, and $0.9 billion Taiwan). This is a drop in the bucket to the $76 billion deployed in the Bay Area last year. However, we expect to see VC investment to ramp up once the funding winter thaws and more foreign inflows of capital enter the market.

Lastly, while challenges do exist, we are encouraged by the level of activity in the startup ecosystems across Japan, Korea, and Taiwan. Innovation is rising in the East and we fully expect to see iconic, global startups to emerge over this decade.

Taiwan is the best kept startup secret. But why?

This island nation of 23 million does not get the credit that it deserves for fueling global innovation 💡

The largest semiconductor company (TSMC), the largest contract manufacturer (Foxconn), and three of the top ten PC companies (Acer, Asus, MSI) are based in Taiwan.

Taiwan is a global center for product design, creating everything from Lululemon clothes to professional sports equipment to 75% of parts in Telsa cars.

Notable startups like Gogoro, KKBOX, KKday, 17 Media, and iTutorGroup have become or are close to becoming unicorns.

Taiwan graduates the largest number of technical talent in the globe per capita, and Taiwanese engineers are highly respected and sought after.

The government has invested into supporting startups through a robust set of accelerators, grants, and work spaces such as Taiwan Tech Arena, Startup Terrence, and Taiwan Startup Stadium.

The government also launched the Gold Card, a 3-year visa to bring talented professionals to Taiwan to boost the talent pool, and has already brought in folks like Steve Chen, Kevin Lim, Tim Draper, Vitalik Buterin, and others.

And Taiwan is a very desirable location to live. It is 1st globally for health, wellbeing & safety, 2nd for quality of life, and 3rd for top expat destinations.

However, as with any emerging startup ecosystem, Taiwan has challenges. The population is growing older, management culture is highly hierarchical, innovation differs from the West in focusing more on a cost down model, and there is a very large talent gap yet to be filled.

Huge shout out for our speakers today Jonathan Liao, Elisa Chiu, Bruce Bateman and Kevin Lin for all that they shared, and to the teams at Futureward and ARK TPE for hosting us today 🙌

The exciting news is that Taiwan is rising 🇹🇼🚀 So much learned about Taiwan on day two of 42Geeks. Stay posted for more insights💡

What is the startup scene like in Japan? Short story is startups are happening right now and are a critical driver of Japan's future 🇯🇵🗾

We did a big download on the Japan startup ecosystem yesterday on the first day of the 42Geeks Tokyo tour 🧠

Here is what we learned about Japan & startups:

- Nation of 124 million and the 3rd largest GDP in the world at $4.4 trillion

- Biggest tech firms include Sony, SoftBank, Nintendo, and Recruit

- Startup funding is active, with $6.2 billion USD across 2,240 deals in 2022

- The number of VC's in Japan number over 800, mostly investing at early-stage

- Currently 7 unicorns in Japan including SmartHR, Playco, Smart News, and Opn

- Startups exit earlier, "Series B is the IPO", and M&A is a lot more common of an exit

So startup activity is already quite active, but Japan is making a big bet on its future with a five year plan to grow startup activity 10x to become the biggest startup ecosystem in Asia by:

💵 Investing $10 billion USD into ecosystem

🦄 Fostering the creation of 100 unicorns

How? They plan to do this across three pillars:

🔴 Expand the Network - encourage people to join startups, mentor startups on scaling, get universities more involved

🔴 Funding and Exit Strategy - make stock options more attractive, attract overseas investors

🔴 Open Innovation - foster collaboration between startups and large corporates, tax incentives for innovation

There is a big vision for startups in Japan and it is going to be fascinating to see how the community grows 🚀🚀🚀

In the past, I would have said there are better places to build a startup than Japan ❌ But being in Tokyo this week changed my mind 🙂

I met with tech startups from early-stage to post-IPO on the 42Geekstour, and it is clear that Japan has made considerable progress to support and enable startups.

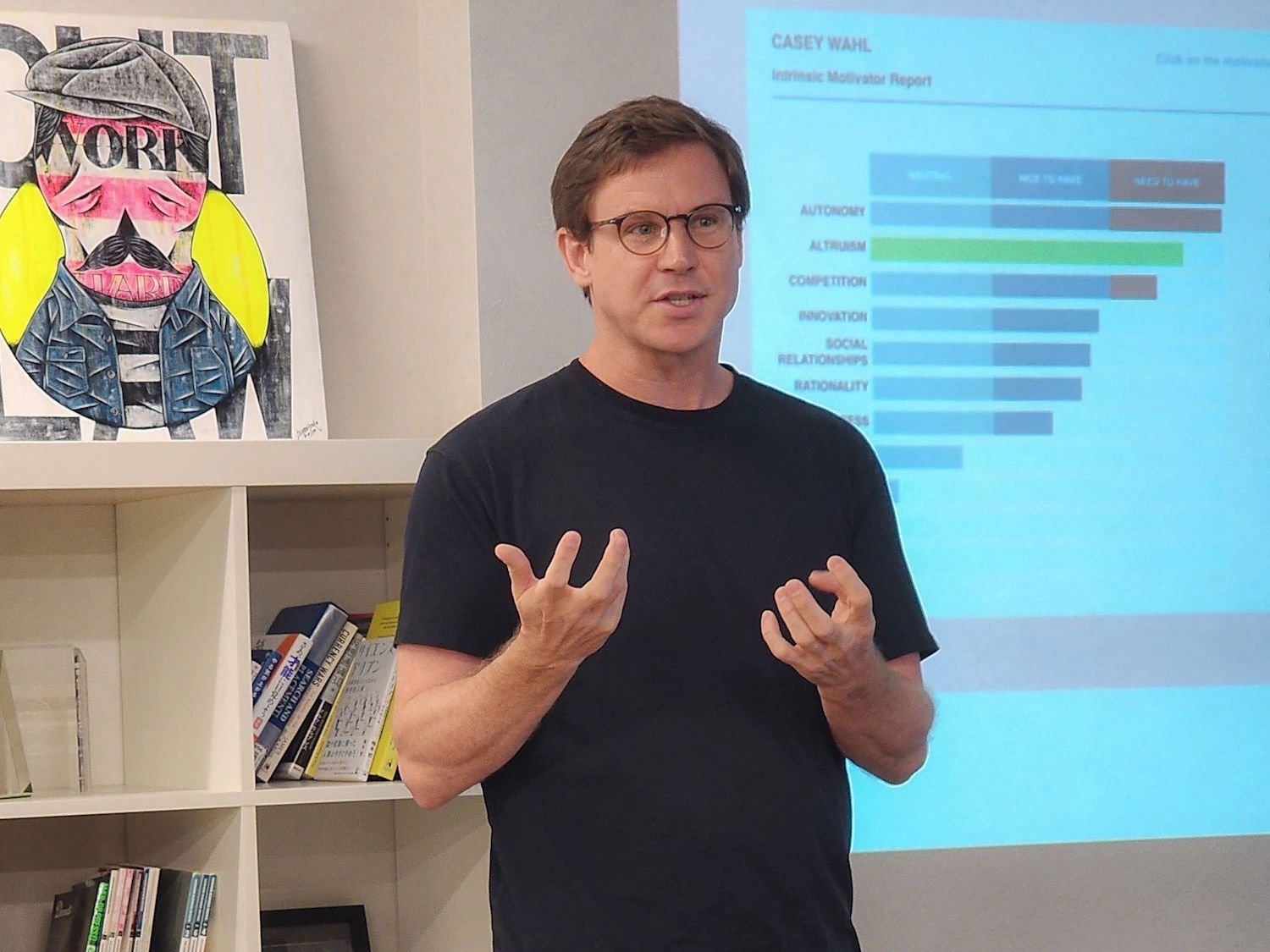

We heard from Casey Wahl, CEO of Attuned, that more people are considering startups for employment, that the level of talent is high, there is plenty of capital available, government is actively supportive, customers tend to be more loyal (less churn), and there is not as much competition compared to other markets.

On our stop at Sansan株式会社, one of Japan's early unicorns and one of the most successful SaaS companies that IPO'ed, their CFO Muneyuki Hashimoto shared that SaaS has been one of the hottest segments for Japanese startups, driven by Japan's big focus on digital transformation, regulatory changes, and the perception that SaaS is a lower risk business model.

At the Moon Creative Lab, we learned from Kenneth Jeng and Linda Kinning on how Mitsui, one of the largest corporations in Japan, has created a venture studio to develop and scale ideas globally from both inside and outside Mitsui to foster greater innovation in Japan.

During the AWS Startup Loft Tokyo fireside chat with Martin Casado, Partner at Andreessen Horowitz, was bullish on the prospects for Japanese startups in hot tech segments such a AI, robotics, and AR/VR.

There are still obstacles however for Japanese startup founders. The most notable risks are:

📍The overwhelming majority of Japanese VC's are not former founders, so they do not have the experience to help startups scale.

📍Japanese startups growth beyond Japan continues to stall because of the lack of talent with international experience.

📍Culturally, the idea of failure is still hard to accept, thus startups tend to take fewer risks and pursue less ambitious ideas.

📍Product adoption tends to be slower as consumers do not adapt to change as quickly, so capital intensive startups can struggle.

All that being said, entrepreneurs and VC's are starting to take note of opportunities in Japan. The international audience that attended Nipponnovation, the many global investors visiting Tokyo this year, polls showing more new college graduates open to joining startups, and the government's bold five year startup plan are all signs that suggest Japan is going to be a global hotbed for startups in this decade 🚀

My time in Seoul was too short due to the holiday🤦 but I wanted to share a few more thoughts on the Korean startup scene 🇰🇷

Any strong startup ecosystem is built on six pillars; government, capital, workforce, infrastructure, market & ecosystem.

Government support

The launches of the Korea Startup Hub and the Seoul Metropolitan Government's Startup Support Center provide founders mentoring, funding & office space. Korea also launched a startup visa called OASIS through KISED, to help foreign startup founders get setup in Korea.

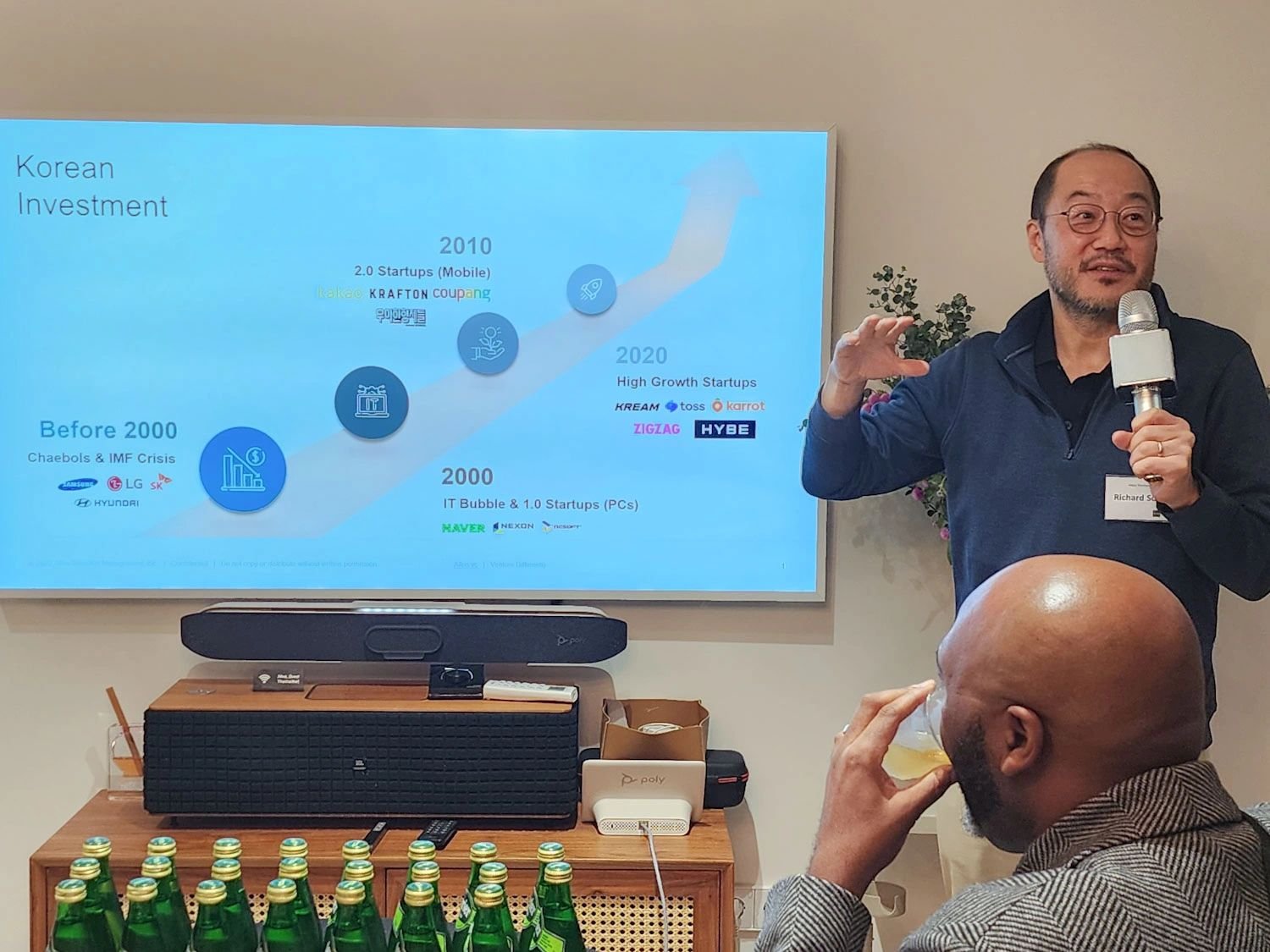

Access to funding

VC funding in 2022 for Korean startups amounted to $5.4 billion USD and the country produced 17 unicorns. In addition, the South Korean government will deploy 10% of a state-backed fund of funds (FoF) to VC investments dedicated to startups every year.

Skilled workforce

The country has one of the world's highest-educated labor forces among OECD countries. According to the Global Innovation Index 2021, Korea ranks 1st globally for number of STEM graduates and 3rd for the quality of its universities, which helps supply talent not only to global giants like Samsung and LG, but also to startups.

Infrastructure

Seoul has very well-developed infrastructure from high-speed internet, to- transportation systems, to world-class facilities, making it easy for startups to connect with customers, partners, and investors. This is supported by a network of over 100 co-working spaces like D.CAMP, DREAMPLUS, HEYGROUND, Idea Factory, SPACES, SPARKPLUS & WeWork.

Market strength

Korea is the world's 11th largest economy, home of massive conglomerates in need of startup innovation to help drive digital transformation, one of the world's highest levels of smartphone adoption, a consumer base of 51 miliion, and well-situated in East Asia with Seoul ideally located for any startup entering Asia.

Ecosystem partners

Startups rely on a network of partners and services to help them along the way. For example, AWS has already invested $2.04 billion into Korea and will grow that to $5.88 billion in the next five years, adding 15,900 jobs and $11.28 billion to South Korea’s GDP, creating more opportunities for startups and allowing them to tap into more resources like AWS Activate and AWS Startup accelerator programs.

One last thing to mention is about cultural attractiveness. Much like Hollywood spread American culture around the world, Korea is riding a wave of global popularity known as Hallyu as their entertainment spreads across the globe. Korea is now both cool and seen as more accessible for foreign startup founders looking to launch in Korea.

That's all for now and awesome work by 42Geeks, Chok Ooi, Dave McClure, Paige Chamberlin, as well as our Korea hosts Dan Choi, Richard Song, and Kyungsun Chung for a great tour of the Korean startup landscape 👏👏👏

Next time I will have to visit Korea when it's not a public holiday 😂 See you again soon!